The S&P500 Futures is one of the most popular stock market indices in the world. It is a contract that tracks the value of the underlying S&P 500 index, which includes 500 of the largest US companies by market capitalization. The futures contract is traded on the Chicago Mercantile Exchange (CME) and can be bought and sold by investors all over the world.

US30 & US500 Day Trading Live Signals | DOW (US30) & S&P (US500) Live Signals With Entry and Exit

The S&P500 Futures live up to their name – they’re a real-time, live feed of the S&P500 index. These futures contracts are traded on the Chicago Mercantile Exchange (CME) and are one of the most popular ways for investors to speculate on the direction of the US stock market.

The S&P500 is a broad-based index that tracks the 500 largest companies listed on the New York Stock Exchange.

It’s widely considered to be a leading indicator of US economic health, so it’s no surprise that the S&P500 Futures are closely watched by traders around the world.

When you trade S&P500 Futures, you’re speculating on where you think the index will be at a future date. If you think it will rise, you buy ‘call’ options; if you think it will fall, you buy ‘put’ options.

The great thing about trading these futures contracts is that they offer leverage – meaning you can control a large amount of money with a relatively small amount of capital. For example, with just $10,000 in your account, you could trade $50,000 worth of S&P500 Futures contracts.

Of course, leverage also magnifies your losses as well as your profits, so it’s important to use stop-losses and take profit levels when trading these contracts.

Nasdaq Futures Live

The Nasdaq Futures Live is a market index that tracks the performance of the top 100 non-financial companies listed on the Nasdaq Stock Market. The index is a modified capitalization-weighted index. The Live nasdaq futures prices are published every 15 seconds during regular trading hours, which are from 9:30 AM to 4:00 PM EST (Eastern Standard Time).

The ticker symbol for the Nasdaq Futures Live is .IXIC. The Base value of the Index is 1000 and was calculated using closing prices on December 31, 1995.

As of June 2017, Apple Inc. (AAPL) was the largest company represented in this index with a weighting of 6.15%. Other notable companies include Microsoft Corporation (MSFT), Amazon.com, Inc. (AMZN), Facebook, Inc. (FB), and Alphabet Inc.’s Google (GOOGL).

The Index is widely used as a benchmark for technology stocks and growth stocks by investors around the world.

S&P500 Futures

The S&P500 is a stock market index that tracks the 500 largest publicly traded companies in the United States. The index is widely considered to be a leading indicator of overall market conditions.

The S&P500 Futures contract is a financial derivative that allows investors to speculate on the future value of the index.

The contract is traded on the Chicago Mercantile Exchange (CME) and can be used to hedge against or take advantage of changes in the underlying index.

The S&P500 Futures contract is one of the most popular contracts traded on the CME, with over $1 trillion in notional value traded each day. The high liquidity and 24-hour trading make it an attractive choice for both day traders and long-term investors alike.

S&P 500 Futures Live Cnbc

The S&P 500 Futures Live Cnbc is an index that tracks the performance of large companies in the United States. The index includes 500 stocks and is considered a leading indicator of economic activity. The S&P 500 Futures Live Cnbc is a market-weighted index, meaning that each stock in the index is weighted according to its market capitalization.

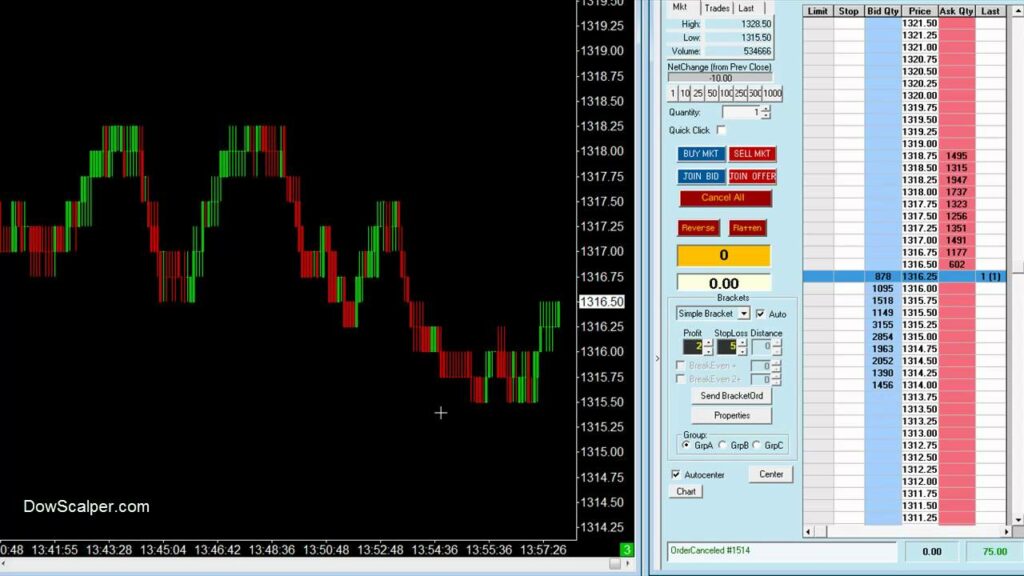

S&P 500 Futures Chart Live

The S&P 500 Futures Chart Live is a tool that allows investors to track the real-time value of the S&P 500 stock market index. The chart is based on data from the CME Group, which operates the world’s largest financial derivatives exchange.

The S&P 500 Futures Chart Live can be used to track the performance of stocks in the United States stock market.

The chart provides investors with a way to monitor the value of their investments in real-time. This can be helpful for making decisions about when to buy or sell stocks.

The chart is also useful for tracking changes in the overall direction of the stock market.

For example, if the S&P 500 Index starts to fall sharply, this may be an indication that a recession is imminent. Conversely, if the index starts to rise rapidly, it could signal that an economic boom is on the horizon.

Overall, the S&P 500 Futures Chart Live is a valuable tool for any investor who wants to stay abreast of developments in the stock market.

It can help you make informed decisions about your investment portfolio and protect your assets during periods of economic turmoil.

Dax Futures

What are DAX Futures?

DAX futures are contracts that allow traders to bet on the future direction of Germany’s benchmark stock index, the DAX. The value of the contract is based on the price of the underlying index, which tracks the performance of 30 major German companies.

The DAX is one of the world’s most popular equity indices, and as such, DAX futures are widely traded. They offer a number of benefits for traders, including exposure to a large and liquid market, as well as tight spreads.

DAX futures are traded on both the Frankfurt Stock Exchange and Eurex exchange.

The most popular contract is the December contract, which is used by many traders to take a position on where they think the index will be at year-end.

How do DAX Futures work?

DAX futures contracts are cash-settled, meaning that no physical delivery takes place.

Instead, at expiration, traders settle their positions by paying or receiving cash based on the difference between their opening price and the settlement price.

For example, if a trader buys one December DAX future at 10700 and holds it until expiration, when the contract settles at 11000, they will receive €300 (11000-10700) per contract multiplied by their position size in euros. If instead the contract had settled at 10600, they would have paid €100 (10700-10600) per contract for their losing trade.

Because there is no delivery involved with these contracts , traders need not worry about owning shares of any particular company . This makes them ideal for those who want to speculate on short-term moves in share prices without taking on any additional risk .

One key thing to remember about trading DAX futures is that because they are denominated in Euros , your profits or losses will be affected by changes in currency values .

So , if you are trading from outside of Europe , it’s important to take this into account when setting your positions .

Dow Jones Futures

The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indices in the world. The index is comprised of 30 large, publicly traded companies from a variety of industries. DJIA futures are financial contracts that give investors the right to buy or sell the underlying index at a set price on a given date in the future.

DJIA futures are traded on the Chicago Board Options Exchange (CBOE) and are one of the most popular futures contracts in existence. They offer investors a way to speculate on the direction of the stock market and hedge against potential downside risk.

There are a number of different strategies that can be employed when trading DJIA futures.

Some traders choose to trade them outright, while others use them as part of a broader portfolio hedging strategy. No matter what your approach, it’s important to have a solid understanding of how these contracts work before putting any money on the line.

S&P 500 Futures Live Cnn

If you’re an investor, there’s a good chance you’ve heard of the S&P 500. It’s a stock market index that tracks the 500 largest publicly traded companies in the United States. And it’s often used as a barometer for the overall health of the U.S. stock market.

The S&P 500 is also one of the most popular futures contracts traded on the CME Group exchange. Futures contracts are agreements to buy or sell a certain asset at a set price at some point in the future. And investors use them to speculate on where they think an underlying asset, like the S&P 500, will be trading at some point down the road.

If you’re thinking about trading S&P 500 futures, there are a few things you should know first. In this article, we’ll give you an overview of what S&P 500 futures are and how they work. We’ll also provide some key tips for trading these popular contracts successfully.

So, what exactly are S&P 500 futures? As we mentioned earlier, they’re agreements to buy or sell the S&P 500 index at a specific price on a specific date in the future. These contracts trade on the CME Group exchange under ticker symbol SP (the actual index is SPX).

You can trade S&P 500 futures electronically 24 hours a day, 5 days a week through CME Globex® platform . There’s also an open outcry session held from 9:30am to 4:00pm CT each business day .

S&P 500 Futures Ticker

If you’re a trader, investor, or just interested in the stock market, you might be wondering what the S&P 500 futures ticker is. This index is one of the most important stock market indexes in the world, and it’s used to track the performance of large-cap stocks. The S&P 500 Index is made up of 500 stocks that trade on US stock exchanges.

It’s a broad-based index that covers a wide range of industries, making it one of the best gauges of the US stock market.

The S&P 500 futures contract is traded on the Chicago Mercantile Exchange (CME). The ticker for this contract is SP.

The contract prices 100 times the value of the underlying S&P 500 Index. So if the S&P 500 Index is trading at 2,000 points, each SP Futures contract will be worth $200,000.

The SP Futures contract is one of the most popular contracts traded on CME Group’s exchanges.

It’s used by traders to speculate on where they think the underlying index will be at a certain time in future. For example, if a trader thinks that the S&P 500 will rise to 2,100 points by December 2020, they would buy an SP Futures contract with a December 2020 expiration date. If their prediction turns out to be correct, they’ll make a profit when they sell their contract before it expires.

If their prediction turns out to be wrong andtheS&P500 falls below 2,000 points by December 2020 ,they’ll incur a loss .

Credit: beef2live.com

What is the S&P 500 Futures Live

The S&P 500 Futures Live is a real-time index of the prices of 500 stocks that are traded on the New York Stock Exchange (NYSE). The index is calculated and published by Standard & Poor’s, a financial information company.

The S&P 500 Futures Live is used by investors and traders to get an idea of how the stock market is performing.

The index is also used by analysts to predict future movements in the stock market.

The S&P 500 Futures Live was created in 2013, and it is updated every 15 seconds during trading hours.

It Provides Investors With a Way to Track the Performance of the Us Stock Market, And is Often Used As a Barometer for the Health of the Us Economy

The Dow Jones Industrial Average (DJIA), also known as “The Dow”, is one of the oldest and most widely-recognized stock market indices in the world. It consists of 30 large, publicly traded US companies spanning a variety of industries. The DJIA is used as a way to track the performance of the US stock market, and is often seen as a barometer for the health of the US economy.

Investors can buy and sell shares of DJIA-listed companies through regular stockbrokers, and many index funds and exchange-traded funds (ETFs) track the index. Because it only includes large, established companies, some investors see the DJIA as being less risky than other indices that include small or mid-sized businesses. However, because it doesn’t sector weighting or account for different company sizes, some argue that it isn’t an accurate representation of the overall US stock market.

How Can I Access the S&P 500 Futures Live

If you want to trade S&P 500 futures, you have a few different options. One is to go through a broker that offers access to the CME Globex trading platform, which is where most futures contracts are traded. Alternatively, some brokers offer access to the ICE Futures U.S. exchange, which also trades S&P 500 futures.

To find out which brokers offer access to these exchanges, you can check out our broker comparison tool. Once you’ve found a suitable broker, you’ll need to open an account and fund it with enough money to cover the margin requirements for your chosen contract.

Once your account is funded and approved for trading futures, you can start placing orders through your broker’s trading platform.

To get real-time quotes for S&P 500 futures, you’ll need to use a live data feed such as the one provided by CME Group.

It is Also Possible to Trade Directly in the Futures Market Through Some Online Brokerages

You can trade futures contracts directly on the futures exchange through a registered broker. Or, you may be able to trade them indirectly through some online brokerages. Futures contracts are standardized agreements to buy or sell a certain asset at a specified price and date in the future.

The assets that underlie futures contracts include commodities, stocks, bonds, and currencies.

Futures exchanges are regulated by the Commodity Futures Trading Commission (CFTC). The CFTC’s role is to protect market participants from fraud, manipulation, and other abusive practices related to derivatives trading.

When you trade futures contracts through an online brokerage, you will likely have to open a margin account. This type of account allows your brokerage to lend you money to help you finance your trades. The amount of money that you can borrow from your brokerage will depend on the specific rules of the exchange where the contract is traded as well as your own broker’s policies.

Before trading futures contracts, it’s important to understand the risks involved. Futures trading is considered a high-risk activity because prices can fluctuate dramatically and move against your position very quickly. It’s also important to be aware of potential fees and commissions that may be charged by your broker when you trade futures contracts.

What Do I Need to Know before Trading in the S&P 500 Futures Live

When it comes to trading the S&P 500 Futures live, there are a few things that you will need to know in order to be successful. For starters, you need to have a firm understanding of what the S&P 500 is and how it works. This index is composed of 500 large-cap stocks that trade on the New York Stock Exchange (NYSE) or the Nasdaq.

The weighting of each stock within the index is based on its market capitalization.

The S&P 500 Futures contract is traded on the CME Globex electronic trading platform and can be accessed via most futures brokers. The contract is quoted in U.S. dollars and each tick represents a $10 move in price.

One contract equals 50,000 U.S. dollars worth of exposure to the underlying index (i.e., $50 per tick).

When trading the S&P 500 Futures live, it is important to keep an eye on two key pieces of data: the level of the index itself and the value of the U.S. dollar Index (DXY).

The S&P 500 Futures Live Contract is a Contract for Difference (Cfd), Which Means That Traders Do Not Actually Own Any Shares in the Underlying Index

The S&P 500 Futures Live contract is a contract for difference (CFD), which means that traders do not actually own any shares in the underlying index. Instead, they are speculating on the direction of the index, with the aim of making a profit from their predictions.

The value of the contract is based on the price of the underlying index, and so when you open a position you will need to put down a margin.

This is because CFDs are leveraged products, which means that you only need to put down a small deposit in order to trade on much larger amounts. This can magnify your profits – but also your losses.

When trading S&P 500 Futures contracts, you will need to be aware of the overnight funding rate.

This is an additional charge that is applied to leveraged positions held overnight, and it can have a significant impact on your overall profitability.

Instead, They are Simply Speculating on Whether the Price of the Index Will Go Up Or down

When it comes to trading, there are two main types of analysis that traders use to make decisions: technical and fundamental. Technical analysis focuses on charts and patterns to try and predict future price movements, while fundamental analysis looks at economic indicators to gauge the health of a country’s economy and its impact on the markets.

One type of analysis that falls somewhere in between these two is index trading.

Index trading is when you trade an index, such as the S&P 500 or the Dow Jones Industrial Average, rather than individual stocks. Indexes are made up of a basket of stocks, so when you trade an index, you’re essentially buying or selling all the stocks in that index at once.

Indexes can be traded using both technical and fundamental analysis.

However, many index traders focus more on technicals since they provide a clear picture of past price action and can be used to predict future movements. Fundamentals can be helpful in understanding the overall direction of an economy, but they don’t always have a direct impact on short-term price movements.

If you’re interested in index trading, there are a few things you need to know before getting started.

First, indexes tend to be much less volatile than individual stocks, so they may not provide as much opportunity for profit. Second, indexes are often traded using leverage, which means you can control a large position with a small amount of capital. This can magnify both your profits and your losses, so it’s important to use stop-loss orders and limit your risk exposure.

Conclusion

The S&P500 Futures Live blog post covers the basics of what futures contracts are and how they work. It also explains the different types of S&P500 futures contracts that are available to trade.